David Rockefeller (2nd from right) and his children Richard Rockefeller, Neva Goodwin, and David Rockefeller, Jr.

Lessons from Family Philanthropy

The Growth of Family Foundations

The Foundation Center in Washington, D.C. defines a family foundation as one that derives its funds from the members of a single family, with at least one family member serving as an officer or board member. By this definition, there are over 40,000 family foundations in the United States in 2016, making grants totaling more than $21.3 billion a year. This represents a sizable increase from the roughly 3,200 family foundations in 2001, then giving $6.8 billion annually. However, there is enormous range among family foundations in size and scope. More than 60 percent of today’s family foundations have assets of less than $1 million. Half of all family foundations make less than $50,000 in grants annually.

Although statistics were not compiled in quite the same way at the time, it is estimated that the Rockefeller Brothers Fund joined company with approximately 470 other family foundations when it was founded in 1940.

The astonishing rise in family foundations may be explained by several perceived advantages, including tax breaks. But perhaps more compelling, family foundations offer donors the means to shape and control their giving. They also can design programmatic objectives to have greater impact than individual donations to established charitable organizations. Furthermore, family foundations have fewer restrictions than donor-advised funds, which are administered through investment funds and do not necessarily provide the chance to design a comprehensive philanthropic program.

Launching family foundations is often the expression of donors’ desires to establish a lasting legacy and to instill in future generations the importance of giving. But family foundations face certain common pitfalls as well. They may initially unite family members through a shared sense of mission that could become less shared as the family grows and diffuses over time. If not chartered to operate in perpetuity, they run the risk of splintering or disbanding when family members hold conflicting values or disagree on priorities.

The RBF is often held up as an example of a family foundation that has weathered these storms successfully. How might the ingredients of its success be described? What lessons can it offer?

1. Join Forces Within the Family

The Fund was established by five brothers who were third generation beneficiaries of the enormous Standard Oil fortune. The importance of giving had been instilled in them from childhood. Their grandfather, John D. Rockefeller, and their father, John D. Rockefeller, Jr., had given hundreds of millions of dollars to causes ranging from public health to scientific research to nature conservation, architectural preservation, the arts, and social services. These two men had founded institutions including the Rockefeller Institute for Medical Research (now Rockefeller University), the General Education Board, the Rockefeller Foundation, Jackson Hole Preserve, Inc., Colonial Williamsburg, and the Riverside Church. They also were instrumental donors to countless other organizations, from New York’s International House to Spelman College in Atlanta, Georgia.

The Fund’s founding brothers represented an evolution within Rockefeller family philanthropy, if only in their sheer number. Their father and grandfather had trusted advisers rather than actual peers. The brothers, on the other hand, were a committee of five, equal to each other, but with distinct personalities. The original impetus for the RBF was to leverage the philanthropic impact of their money and the cultural impact of the family name. In their young adulthood, the brothers were already giving independently, sometimes to the same recipients. Collective giving gave their philanthropy more impact and eliminated redundancy. Collective decision-making established an institutional culture of collaboration and cooperation at the RBF from the start.

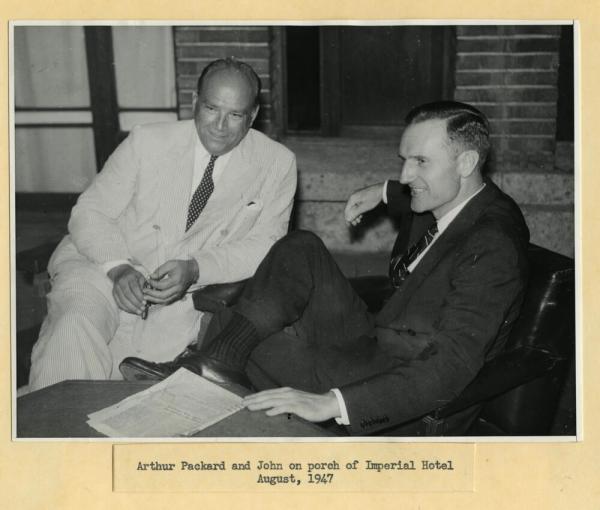

For its first ten years, the Fund was governed by a board consisting only of the brothers, with Arthur Packard of the Rockefeller family office providing day-to-day administration. It had no endowment, but rather disbursed grants from funds each brother contributed annually according to his means. By the early 1950s, the RBF was poised to take its first steps of growth. Each of these steps also reflected its identity as a family foundation. In 1950, Dana S. Creel was appointed director of the RBF, the first professional staff to devote 100 percent of his time to the Fund. (He later became the Fund’s first non-family president.) Then, in 1951, the Fund received a gift of $58 million from John D. Rockefeller, Jr., establishing an interest-generating endowment for the first time. Perhaps equally important, this gift signaled the senior philanthropist’s approval of the RBF enterprise. The endowment enabled the Fund to formulate and enact its own projects in addition to regular grantmaking. The first of these was the Special Studies Project, conceptualized and led by Nelson Rockefeller beginning in 1956. The second was the Fund’s West Africa program, launched in 1959.

2. Seek the Expertise of Informed Outsiders

Another growth step of the 1950s was the expansion of the board. In 1951, the RBF elected its first two non-family trustees, Detlev Bronk and Wallace Harrison. Indicative of the Fund’s retention of its strong donor influence, both men were close colleagues of the family, and had already been involved in several other Rockefeller initiatives. From this point forward, the RBF welcomed authentic and active involvement from outside the family, which has provided important perspectives, ideas, and balance. In 1954, the brothers’ only sister, Abby “Babs” Rockefeller Mauzé, joined the board. In 1958, her daughter, Abby M. O’Neill, became the first trustee drawn from the fourth, or “cousins” generation, and these two trustees represented the initial expansion of family membership on the Fund’s board.

Today, in 2016, RBF board membership is roughly evenly divided between family and non-family trustees. (Current board membership totals 17, with 9 non-family and 8 family trustees.) The role of chairperson is reserved for a family member, although this is an informal policy not specified in the by-laws. Also, spouses, adopted children, and stepchildren are considered family. The Fund relies on an extensive search and review process by its nominating committee to fill both family and non-family seats.

3. Manage Growth through Professionalization

The Fund continued to grow throughout the 1960s. When John D. Rockefeller, Jr., died in 1960, he bequeathed half of his estate to the RBF. This moved the Fund into the top ten American foundations as measured by resources. The Fund also increasingly professionalized, hiring half a dozen new program officers from the mid-1960s through the early 1970s, several of whom went on to serve the Fund for 30 or 40 years. These staff members began to shape the Fund’s activities along more targeted programmatic lines. In 1971, the Fund conducted its first comprehensive program review, and began creating thematic initiatives within the umbrella of the existing geographically based program categories. These included an Environmental program, a Southern U.S. program, a New York City Education program, and a program in Equal Rights and Opportunities, among others.

4. Integrate Younger Generations in a Guided Way

By this time, the founding brothers, now in their 60s and 70s, had also begun to grapple with the future of the Fund. A key ingredient of prolonged success at family foundations is the integration of younger generations, and this integration proved as challenging for the RBF as it has for many others. In 1967, the brothers supported the establishment of the Rockefeller Family Fund (RFF) as a means of training their children (the “cousins”) and the family’s fifth generation in trusteeship and foundation philanthropy. They also intended that some of these younger family members would eventually move into service on the RBF board. For its first several years, the RFF was funded by the RBF and David Rockefeller served as its chair. It took on many of the family’s smaller, more local philanthropic interests in both Westchester County, New York, and Mt. Desert Island, Maine. By the 1970s, the RFF appointed a cousin, David Rockefeller, Jr. as its chair and had adopted programmatic interests in the environment and women’s equality. Around the same time, the RBF created two non-voting “visitor” slots on its board, which the cousins could volunteer to fill by rotation.

Inevitably, conflicts over values still arose. The brothers had come of age in an earlier part of the twentieth century. They tended to be institutionally focused, with high-level networks of contacts and influence in both government and industry, and had all served in World War II. To the generation coming of age in the 1960s and 1970s, the brothers were the very embodiment of “the establishment.” Many of the Rockefeller cousins had embraced countercultural critiques including opposition to American involvement in Vietnam, new forms of spirituality and environmentalism, and an anti-authoritarian, even anti-capitalist, ethos. Some of the brothers, Nelson in particular, wondered if their children would govern the RBF with a perspective compatible with the Fund’s original values, and suggested that perhaps the RBF ought to spend down its funds and close its doors when the founding trustees’ tenures came to an end. Other brothers, John 3rd in particular, were more committed to continuity, even if this entailed evolution and change. The RBF board experienced sharp conflict over this matter throughout the 1970s.

5. Honor Longstanding Commitments Before Moving Forward

The deaths of founding brother Winthrop in 1973 and sister Babs in 1976 heightened the urgency of determining the Fund’s future. Ultimately, the Fund undertook a highly unusual compromise measure. After carefully reviewing its ongoing commitments to 25 major institutions that the Rockefeller family and the RBF had founded and/or perpetually supported, it made “exit” grants of at least $1 million to 19 of these institutions, thus freeing the Fund to change direction under new leadership in the future. Retired RBF president Dana S. Creel returned to head the review process, and the grants become known as the “Creel Committee grants.” They assuaged both sides of the conflict, allowing Nelson to feel as if the RBF had more or less permanently taken care of its longtime institutional grantees and sufficiently expressed the brothers’ legacy. And, although the grants reduced the endowment by half (and thus removed the RBF from the roster of top ten U.S. private foundations), they left an endowment that allowed the RBF to endure. Neva Goodwin, Hope Spencer, Steven Rockefeller, David Rockefeller, Jr., and Winthrop Paul Rockefeller joined their cousin Abby O’Neill on the board during the 1970s.

Also key to the process of moving forward into a renewed vision was the presidency of William Dietel. Dietel had joined the RBF staff in 1970, and he assumed the presidency in 1975 upon the retirement of Dana S. Creel. As the Fund’s first new president in over 30 years, Dietel faced many challenges, but his presence proved essential for the cousins’ generation as they came into their own. He got along well with the cousins and shared many of their values. A strong advocate for new, holistic ways of approaching the environmental crisis in terms of ecosystems and ecology, Dietel brought fresh perspectives to the Fund. Many of the ideas he introduced were reflected in the program revisions of the 1980s that prioritized work in environmental sustainability. Dietel also fostered and encouraged the Fund’s growing support for the non-profit sector, a commitment that expanded throughout the late 1970s and 1980s.

Photo courtesy of the Rockefeller Archive Center.

Abby M. O'Neill, the first of the cousins generation to join the Fund in 1958, and the first woman to serve as board chairperson, 1992-1998. She is pictured here in 1983.

6. Build Bridges Within the Family

Abby O’Neill played a key role in the smoothing of intergenerational struggles. A trustee since 1958, she was closer in age to her uncle David Rockefeller than to the rest of the cousins, and in many ways shared the brothers’ values and experiences. At the same time, the younger cousins trusted her and felt that she listened to their concerns. She became a real bridge during a tumultuous era.

7. Provide for Authentic Involvement by Non-family Members

Donor control became very much an issue in the 1970s, following the passage of the 1969 Tax Reform Act, which required family foundations to separate personal business, including personal philanthropy, from the activities of the foundation. Foundation staff could no longer work informally on family business. While the Act did not require family foundations to include non-family members as trustees, the court of public opinion heavily favored such diversification. The RBF had had non-family trustees in place since the early 1950s, but the founding brothers still very much guided the Fund’s grantmaking. In 1978, trustee John W. Gardner resigned from the board, citing his feeling that the non-family trustees were being used merely in an advisory capacity despite having full voting rights.

Indeed, the increasing measures of professionalization, transparency, accountability, and shared control were difficult for some of the founding brothers to accept. The RBF was no longer their collective philanthropic checkbook, and processes such as agendas, board books, and grant recommendations had become more complex and demanded a higher degree of organization. In three and a half decades, the Fund had developed from informal Sunday afternoon meetings at one of the brothers’ homes and employing a single professional staff member into a fully professional foundation with a board of 19, a dozen program associates, 22 support staff, and 5 consultants.

8. Empower the Creativity of the Next Generation

Sadly, the transition to a new generation of leadership was hastened by the unexpected deaths of the Fund’s first two presidents within six months of each other: John D. Rockefeller 3rd in July, 1978 and Nelson Rockefeller in January, 1979. Yet the sometimes uncomfortable conversations and disagreements that had taken place throughout the 1970s meant that the Fund was surprisingly well prepared to go forward. It had resolved its transitional issues and gained a high degree of institutional self-awareness. In 1980, David Rockefeller assumed the chairmanship of the RBF, the last founding brother to do so. He, in turn, appointed a review committee to assess the Fund’s programs and direction. The committee was headed by David Rockefeller, Jr. and was comprised entirely of cousins and non-family trustees.

The recommendations of the 1981 review committee produced the Fund’s first wholesale program reconfiguration. The new rubric, adopted by the board in 1983, was entitled “One World.” In many ways it expressed the values and vision of the cousins’ generation, especially in its heightened attention to global interdependence, peace building, and environmentalism focused on the issue of sustainability. At the same time, although programs were configured in a new way, the rubric affirmed the longstanding priorities of the Rockefeller family, which had always included the natural world, international relations, and global peace and understanding. David Rockefeller’s encouragement of this new enterprise was widely interpreted as a nod of approval from the founding generation. Although certain modifications were made over the years, One World stayed in place until the Fund introduced new program architecture in 2003, and its concepts and language still permeate the Fund’s program and mission in 2016.

In 1987, the torch of RBF leadership was officially passed to the next generation when David Rockefeller, Jr., succeeded his father as chair. He was the first cousin to serve as chair, as his tenure was followed by the chairmanships of Abby O’Neill, Steven Rockefeller, and Richard Rockefeller. By the early 1990s, the Fund had welcomed its first fifth generation trustees, Catharine Broderick and Joseph Pierson. Not since the 1970s, however, has there been significant conflict between generations. In 2013, Valerie Rockefeller Wayne became the first fifth generation family member to chair the RBF board.

The selection of non-family trustees has also evolved over the years. When the brothers headed the Fund, non-family appointees tended to be drawn directly from their contacts. The cousins and fifth generation family members do not have the same kind of network of people in government and business as the brothers had, although they have extensive networks in their fields of interest. As the Fund has become more specialized in its programs, it has become increasingly common for the president, non-family trustees, and staff to provide guidance and contacts in the search process.

9. Support Family Members’ Interests Where Feasible

The Fund was, during the brothers’ era, a resource for the financing and support of their personal philanthropic endeavors. It supported organizations launched by the brothers including Nelson’s American International Association for Social and Economic Development (AIA), John 3rd’s Population Council, Laurance’s U.S. Virgin Islands National Park, Winthrop’s Arkansas Art Center, and David’s Center for Inter-American Relations (CIAR, now the Americas Society), among many others. As the family has grown and become more diffuse, and younger generations have assumed Fund leadership, the RBF has moved away from family causes with its evolving identity as a professional foundation. Where appropriate to its mission, however, the Fund has occasionally supported projects and organizations launched by family members, for example contributing to the initial operational costs of Synergos, founded by Peggy Dulany, beginning in 1986. Synergos is an organization that works internationally to bring people together to solve complex problems of poverty and create opportunities for individuals and their communities to thrive.

At times, the Fund has been able to support other Rockefeller entities by providing guidance and infrastructural support. In the early 1990s, the Asian Cultural Council (ACC) needed office space, a long-term fundraising plan, and overall strategic redirection. The Fund invited the ACC to share its office space, as the RFF had been doing since its own inception. The RBF then made sizable annual grants to the ACC until it could revise and enact a wider fund raising plan. Both the ACC and the RFF brought external vitality to the Fund. The ACC helped revive the Fund’s engagement with arts and culture, and the RFF’s presence offered fruitful opportunities for communication and collaboration.

Often the Fund has benefited from the interests that family trustees bring to the table, for example its twenty-year involvement in South Africa (from the late 1980s through the mid-2000s) began in large part because South Africa was an area of special concern for Peggy Dulany. However, family members’ interest areas must fit within the Fund’s mission and program focus for the RBF to take them on, which isn’t always the case, even for worthy projects. In the late 1980s, the Fund undertook a short-lived early education program, a special interest of Abby O’Neill’s. Within a few years, however, it exited the field because it simply was not aligned with the Fund’s core endeavors.

The 1999 merger with the Charles E. Culpeper Foundation was a significant development at the Fund. The Culpeper Foundation, where RBF President Colin Campbell was a trustee, had begun as a family foundation but by this time had no remaining family members living. Joining forces with the RBF prolonged its influence and impact, and enabled the philanthropy of its original donors to continue. The RBF in turn benefited from an influx of resources to its endowment, helping it to recover from the effects of the Creel Committee grants. In this case, given compatible mission and vision, the merger exemplifies the consolidation of resources at two family foundations in a way that enhanced the impact of both.

10. Invest Family Resources in Legacy and Mission

Not all family foundations will encounter this dilemma, but the RBF has twice been faced with making decisions regarding family property. The first was Hillcrest, the Westchester estate of JDR, Jr.’s second wife, Martha Baird Rockefeller. Upon her death in 1971, she left the 30-acre property to the RBF. In 1974, the Fund approved the use of the house for a state-of-the-art archive on philanthropy, financed its physical conversion, and gave the new Rockefeller Archive Center (RAC) an endowment. While founded to assemble, preserve, and make accessible the records of the Rockefeller family and their wide-ranging philanthropic endeavors, today the RAC is a research center broadly dedicated to the study of philanthropy, the many domains touched by American foundations (including but not limited to Rockefeller entities), individual donors, and the civil society organizations they support. It holds the archives of more than 60 organizations and individuals, serves 400 researchers annually, and engages in education and outreach to the philanthropic community.

The second Rockefeller property that the RBF was instrumental in repurposing was the Kykuit estate, the family’s historic home for four generations in Pocantico Hills, Westchester County, New York. The National Trust for Historic Preservation had acquired a significant portion of the estate in a bequest from Nelson Rockefeller in 1979, but for many years no consensus could be reached with living family members about how to best utilize this resource. Initially, brothers Laurance and David did not want the property to go to the National Trust, and attempted to buy it back. An additional complication was that Nelson’s will did not make provisions for the ongoing maintenance of the property, and the National Trust did not have sufficient resources to take this on.

After careful consideration of the most enduring and beneficial uses of the property, under the significant leadership of RBF President Colin Campbell, the Fund reached an agreement with the National Trust wherein the Trust would lease the property to the RBF, and the RBF would open it to the public and assume responsibility for the stewardship of the Pocantico Historic Area, which includes overseeing the care, maintenance, and conservation of Kykuit’s historic buildings, gardens, and collections of fine and decorative art. Funds that Abby “Babs” Rockefeller had bequeathed to the RBF helped cover initial expenditures on this large-scale project and Laurance and David worked together to provide an endowment.

In 1994, the RBF opened its Pocantico Conference Center in the estate’s renovated coach barn. The Center is a venue for conferences on critical issues related to the Fund’s mission. It is also a community resource with public programs including tours, lectures, and cultural events. From the beginning, the Pocantico Center has served as an important enhancement to the Fund’s work, enabling it to convene extended meetings on key issues, both national and global in scope, which have often resulted in new networks and policy frameworks. The Center consistently hosts over 70 meetings annually.

Both properties are an expression of the Rockefeller family’s values. Together they support knowledge building about the civil society sector, document the family’s long involvement in philanthropy, engage in public outreach, support arts and culture through residencies and public performances, and further work in international relations, the health of the global environment, and myriad other core concerns.

11. Retain Core Values while Reassessing Situations

In 2014, after more than three decades of work on sustainability and climate issues, the Fund made the path breaking decision to begin divesting its financial holdings from fossil fuels. On the surface, this seemed like a surprising move for a foundation whose holdings derived from the profits of the Standard Oil Company. Yet the Fund had become increasingly devoted to work on climate change, serving as both a leader and catalyst in the field since the 1980s. Now, as the profile of causal factors of climate change had become both clear and alarming, the board felt it must align its resources with its stated mission. Furthermore, it felt called to provide leadership and encouragement for other foundations and investors to follow suit. Rather than characterize the divestment as a break with family tradition, the Fund has instead emphasized that its actions are in keeping with the longstanding Rockefeller ethos of protecting natural resources and cultivating diverse partnerships, and is doing so in a manner appropriate to new understandings and changed global environmental conditions.

Stephen Heintz, RBF president since February 2001, was influential to helping the Fund streamline and retool its program architecture for the twenty-first century. At the same time, he helped ensure that this new architecture would not depart from, but rather would more effectively express, the Fund’s abiding values. Under his leadership, along with that of then-board chair Steven C. Rockefeller, who headed the program review committee, the RBF adopted a comprehensive new program design in 2003. The new rubric introduced the concept of “pivotal places,” a device that continues to help this relatively small family foundation achieve outsized impact. During Heintz’s tenure, the RBF has also amplified its commitment to fostering democracy and civil society, both domestically and internationally. It has lived its environmental values by designing an office space that has received a rare LEED platinum designation. And it has worked increasingly in the area of peacebuilding. The RBF responded quickly to the events of September 11, 2001, launching a U.S.–global engagement initiative. It launched a program in Egypt shortly after the 2011 Arab Spring. It played a major role in enabling and encouraging the track II dialogue between the United States and Iran over more than a decade, from 2002 to the present.

12. Balance Core Identity with Flexibility

While philanthropy may be an important family tradition, in order to sustain family identity over time, shared values must be larger, as well as more specific, than the simple act of giving. The Rockefeller family has been committed to philanthropy based on guiding principles including caring for Earth’s biosphere, supporting and bringing to the public the beauty of the fine arts, and fostering justice, peace, equity, and democratic processes within the U.S. and internationally.

The longevity of the RBF is significantly attributable to its capacity as an organization to allow new concerns to emerge in each successive generation, and its willingness to let new generations formulate their own responses to the pressing issues of their times.