Investors Can Pursue Impact Without Sacrificing Returns, Perella Weinberg Partners Finds

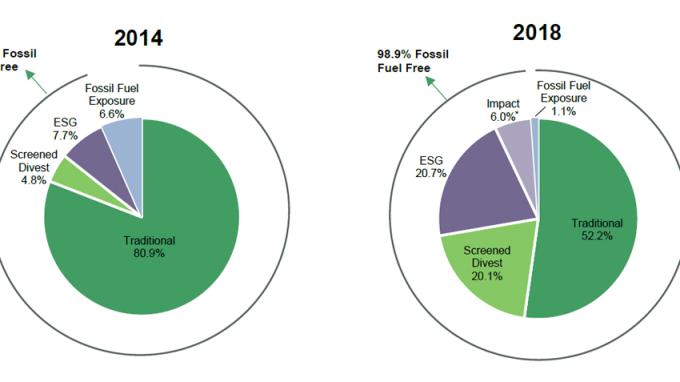

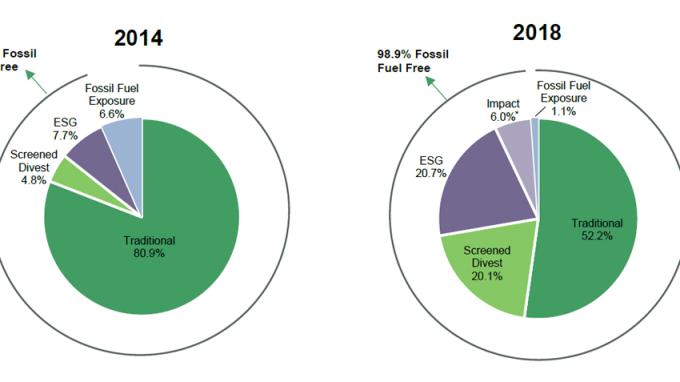

The Evolution of the Rockefeller Brothers Fund’s Mission-Aligned Portfolio

*As of December 2014, $15 million had been committed to impact investments, representing approximately 1.7% of the total portfolio. As of December 2018, $151.4 million has been committed, approximately 13.5%.

The Rockefeller Brothers Fund strives to be a model of philanthropic excellence and transparency. As part of this commitment, the Fund regularly reports on Institutional Effectiveness and Program Impact and offers resources to others in the field of philanthropy. As the Fund's mission-aligned investment efforts near the five-year mark, we will increasingly share materials to illustrate our approach and learning on this new tenet of our work and reflect on its challenges, impact, and outcomes.

A new paper released by Perella Weinberg Partners (PWP) finds that investors can pursue both financial returns and social or environmental impact simultaneously. Since 2014, PWP Agility has served as the Outsourced Chief Investment Office (OCIO) for the Rockefeller Brothers Fund, which features heavily in the new publication, It’s More Than Just Talk. This partnership has helped shape PWP’s belief that returns and impact are not mutually exclusive.

It's More Than Just Talk examines the myths surrounding mission aligned investing that PWP is working to demystify. In debunking the misconception that mission-aligned investing lowers expected returns, the paper emphasizes that there is no one-size-fits-all strategy for investors. Foundations, universities, and other institutional investors must develop a shared understanding of mission alignment and clear goals for their investments, then choose from a spectrum of approaches to meet them. These can include applying an exclusionary screen (Divestment), choosing fund managers that integrate environmental, social, and governance (ESG) criteria into the security selection process, and investments focused on specific environmental or social impact.

The paper details how the Rockefeller Brothers Fund employs all three strategies in its mission-aligned investment efforts. In 2014, the Fund committed to divest its endowment from fossil fuels and set a target to allocate 10 percent of its portfolio to impact investments, which it has since increased to 20 percent. In addition, the Fund has committed more than $227 million of its $1.16 billion endowment to ESG investments.

“Under the careful guidance of our Investment Committee in collaboration with Perella Weinberg Partners, our mission-aligned investment strategy has consistently exceeded benchmark returns,” said Stephen Heintz, president of the Rockefeller Brothers Fund. “As more and more foundations, universities, and organizations discover and share the benefits of mission-aligned investing, we’ve seen a greater breadth of impact and ESG investment opportunities emerge that we hope will attract others to invest with their conscience. In the nearly five years since the Rockefeller Brothers Fund embarked on our mission-aligned investment efforts, we’ve never once looked back.”