Beyond Divestment: RBF Commits to Decarbonizing our Investment Portfolio

For over 80 years, the environment has been one of the most enduring commitments of the Rockefeller Brothers Fund (RBF).

Last November, the RBF adopted a plan to spend an additional $100 million over the next ten years to address the climate crisis and the political and economic systems that drive and reflect it. Climate-related grants will constitute just under 50 percent of the Fund’s total 2023 grantmaking.

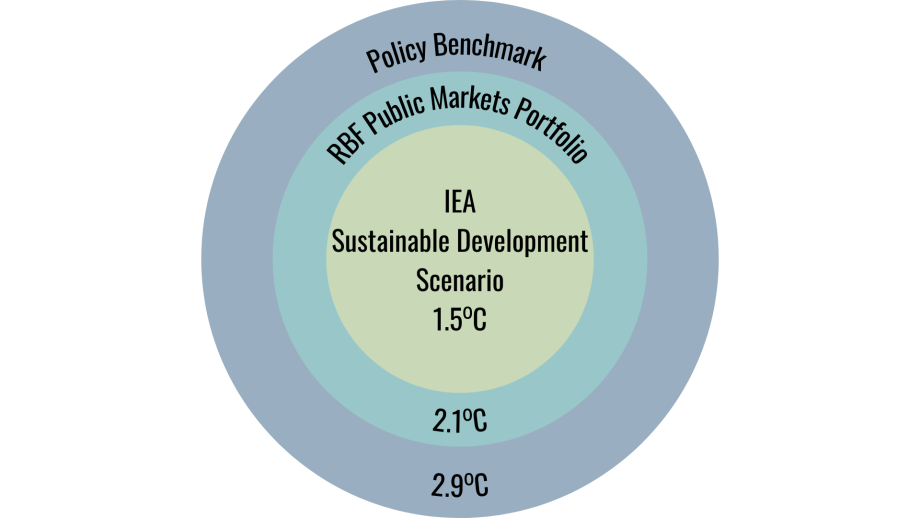

Today, the RBF released a report describing new steps we are taking to further align our investment portfolio with global climate goals long supported by our grantmaking programs. In Beyond Divestment: Decarbonizing Our Investment Portfolio, we share findings from an initial carbon footprint analysis of our investments. Our endowment portfolio is already a climate outperformer; however, it falls short of the imperative to limit global temperature rise to 1.5 degrees Celsius.

ASSOCIATED TEMPERATURE INCREASE BY 2050

Going forward, the RBF is working to align our endowment portfolio with science-based emission targets. The report outlines further steps the RBF will take to decarbonize its endowment, support the development of industry standards, and mobilize peers to help accelerate a just transition to a low-carbon economy.