BEYOND DIVESTMENT: Decarbonizing our Investment Portfolio

KEY TAKEAWAYS

- In November 2022, the Rockefeller Brothers Fund (RBF) adopted a plan to spend an additional $100 million over the next ten years to address the climate crisis and the political and economic systems that drive and reflect it.

- The RBF is committed to reducing emissions from our investment portfolio to align with global climate goals long supported by our grantmaking programs.

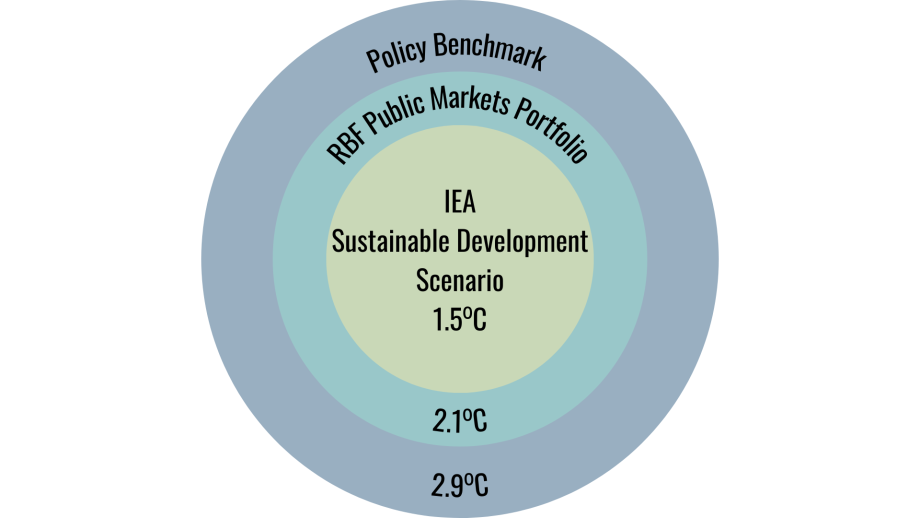

- A recent analysis indicates our endowment portfolio is already a climate outperformer; however, it falls short of the imperative to limit global temperature rise to 1.5 degrees Celsius.

- Going forward, the RBF will take steps to further decarbonize its endowment, support the development of industry standards, and mobilize peers to help accelerate a just transition to a low-carbon economy.

INTRODUCTION

The environment has been one of the most enduring commitments of the Rockefeller Brothers Fund (RBF). For more than 80 years, our grantmaking has supported conservation, ecosystem management and, since 2003, climate change mitigation and resilience. In 2023, climate-related grants—including the full Sustainable Development, Democratic Practice–Global Challenges, and China grantmaking programs, as well as portions of our Central America and Western Balkans grantmaking—will constitute just under 50 percent of the Fund’s total grantmaking budget.

In November 2022, the RBF board of trustees adopted a plan to spend an additional $100 million to address the climate crisis over the next ten years. This includes funding for related work to build democratic institutions and practices that can enable meaningful climate policy and to transform violent conflict that is both driven by and exacerbates weather-related migration and competition for natural resources. The 2023-24 budget approved under this plan provides a 23 percent increase over our typical grantmaking budget.

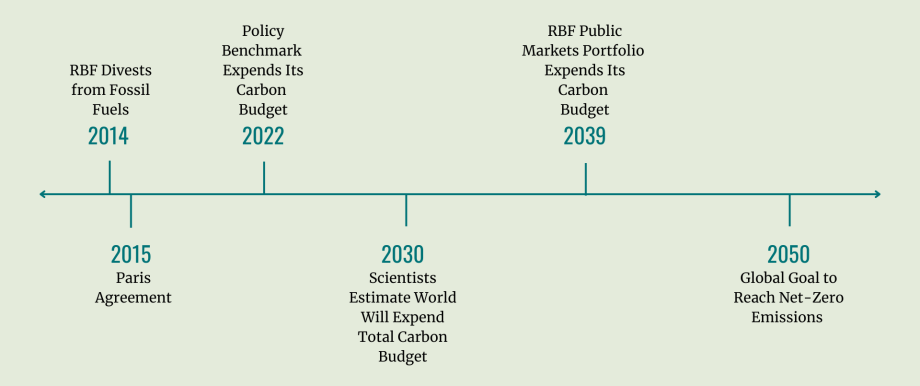

As it became clear that our investments at times contradicted our climate-related grantmaking efforts, in September 2014, the RBF announced our intention to divest from fossil fuels. Today, the RBF endowment is more than 99 percent fossil fuel-free. But as the climate crisis grows more urgent with every superstorm and megadrought, we have determined that eliminating our exposure to fossil fuel holdings alone is not enough.

Now, the RBF is working to align our endowment portfolio with science-based emission targets1 to keep global temperature rise under 1.5 degrees Celsius above preindustrial levels, which scientists tell us is the only way to avoid the most severe impacts of climate change.

CARBON FOOTPRINT ANALYSIS

In 2022, we began a process to better understand and work to minimize all the ways that we and the companies we invest in contribute to greenhouse gas emissions that warm the planet.

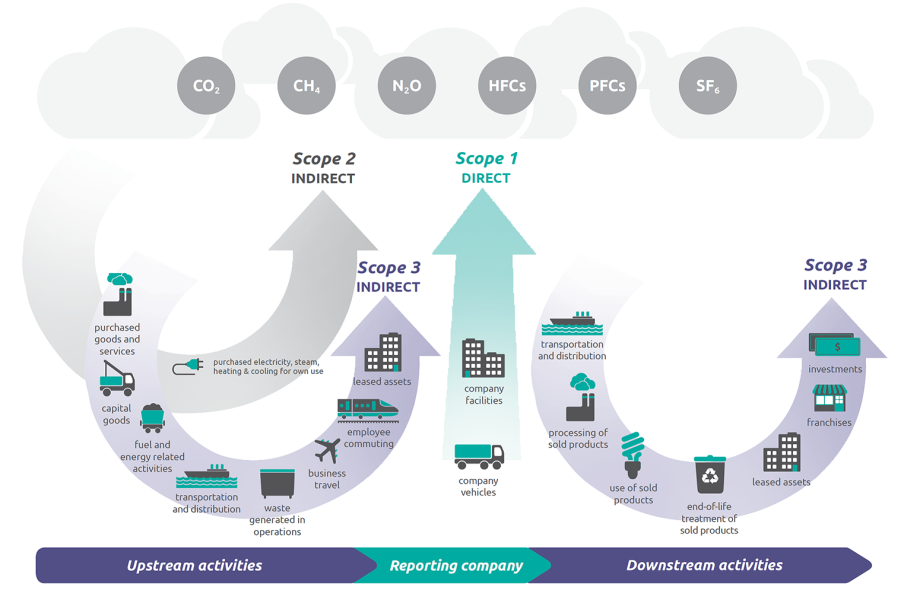

We assembled a working group of experts from our finance staff and Investment Committee, as well as grantmakers from our Sustainable Development and Democratic Practice—Global Challenges programs, to work with our Outsourced Chief Investment Office, Agility. They started by commissioning an analysis of the Scope 1, 2, and 3 emissions our Public Market and Private Capital investments produce to identify the starting point from which we could map the work ahead.2

Image courtesy of World Resources Institute.

Scope 1 emissions are produced directly by a company’s operations. Scope 2 emissions are generated by the production of energy, like electricity, a company purchases for its operations; although the emissions are created outside the company’s control, the company does exercise control over how much energy they use and where they purchase it. Scope 3 emissions, also known as value chain emissions, are further outside a company’s control, including those emitted during the production of raw materials used for their products (upstream) and the consumption of their products (downstream).

Take for example a baker who produces gourmet chocolate chip cookies. The baker’s Scope 1 emissions might come from the gas stove used to bake the cookies; her Scope 2 emissions might come from electricity purchased to power the lights, mixers, and timers in the bakery; and her Scope 3 emissions might have been produced by the manufacturer of her oven, the tractor that harvests the wheat for her flour, and the plane used to import her gourmet chocolate (upstream), as well as her disposal of shells from eggs in the recipe, shipping the cookies to her customers, and consumers’ disposal of the packaging (downstream).

“This will initially be a data analysis effort. As that data comes in, we should determine what we want to focus on; is it the carbon emitters or relative carbon emitters? Do we want to depart high-emitting industries or invest in their most carbon-neutral producers?”

—Bill Lee

Working Group Colead

Public Markets Analysis

The analysis by ISS found that, overall, the RBF’s public markets portfolio3 outperforms our portfolio policy benchmark. As is common with investment funds, the RBF measures its portfolio against generic indexes to assess whether performance simply reflects the markets or is indicative of good investment management. The RBF endowment uses a benchmark that is 70 percent a global equity index and 30 percent a global fixed income index.4 Deviations from the policy benchmark as it relates to carbon emissions show the effects of RBF’s divestment and decarbonization efforts. (In our ongoing work, the RBF will engage with ISS to evaluate additional options for emissions comparisons.)

The RBF portfolio emits roughly 50 percent less per dollar invested in Scope 1 and 2 emissions than the benchmark; when including Scope 3 emissions, that number drops to 13 percent. But the RBF portfolio falls short of the imperative to limit global temperature rise to 1.5 degrees.

ASSOCIATED TEMPERATURE INCREASE BY 2050

ALLOCATED CARBON BUDGET LIFETIME

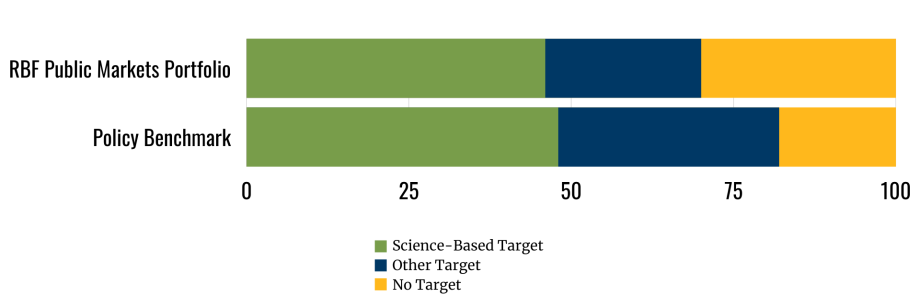

PERCENT PORTFOLIO COMPANIES WITH CLIMATE TARGETS

Private Capital Analysis

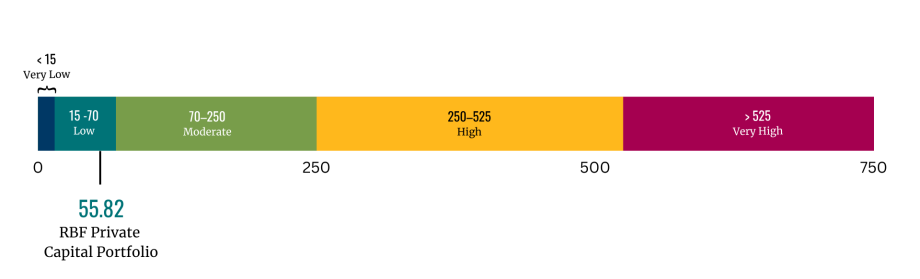

In its review of the Fund’s Private Capital portfolio, Burgiss analyzed our “weighted average carbon intensity.” This analysis showed that the Fund’s private investments have limited exposure to carbon-intensive companies that would experience significant losses or devaluation if policies were adopted to meet the 1.5-degree threshold by restricting carbon emissions.

WEIGHTED AVERAGE CARBON INTENSITY

NEXT STEPS

Though other asset owners may have larger pools of capital, our modest size allows us to be nimble and adaptive as we work to create meaningful change through our grantmaking and investing strategies. We know that the RBF still has a long way to go to align our endowment with global climate goals and we are committed to helping others do the same. Over the next several years, we will continue to identify ways to decarbonize our endowment, support the field to standardize emissions data collection and availability, and share lessons learned to help mobilize our philanthropic peers and other institutional investors to accelerate a just transition to a low-carbon economy.

DECARBONIZE

- Analyze emissions in both the Public Markets and Private Capital portfolios annually.

- Examine top emitters and evaluate whether to engage fund managers or shift investments.

- Work with partners on collective action to press portfolio companies to set climate-related targets.

STANDARDIZE

- Support increased availability of carbon emissions data and analysis.

- Advocate for comprehensive Scope 3 emissions reporting.

- Promote further development of industry standards.

MOBILIZE

- Participate in peer convenings and net-zero investor communities, domestically and internationally.

- Track and share reporting enhancements, new features, and opportunities for action.

- Identify leadership opportunities for the RBF to advance peer efforts and market changes that support a just transition to a low-carbon economy.

Notes

1. The RBF refers to the International Energy Agency’s Sustainable Development Scenario, which details a pathway to enable the world to meet climate goals that are fully compliant with the Paris Agreement. Back to report →

2. The working group selected ISS as the carbon footprint analysis provider for the public portfolio and Burgiss for the private portfolio. Back to report→

3. ISS was able to analyze 91.3 percent of RBF’s Public Market investments, representing 41.8 percent of RBF’s total portfolio. Back to report→

4. The policy benchmark, set by the RBF Investment Committee and defined within the RBF Investment Policy Statement, is 70 percent MSCI ACWI, 30 percent Bloomberg Global Agg. Both components are indexes with a changing set of constituents, so they are not able to set carbon emissions targets. Back to report→